The PCI Files

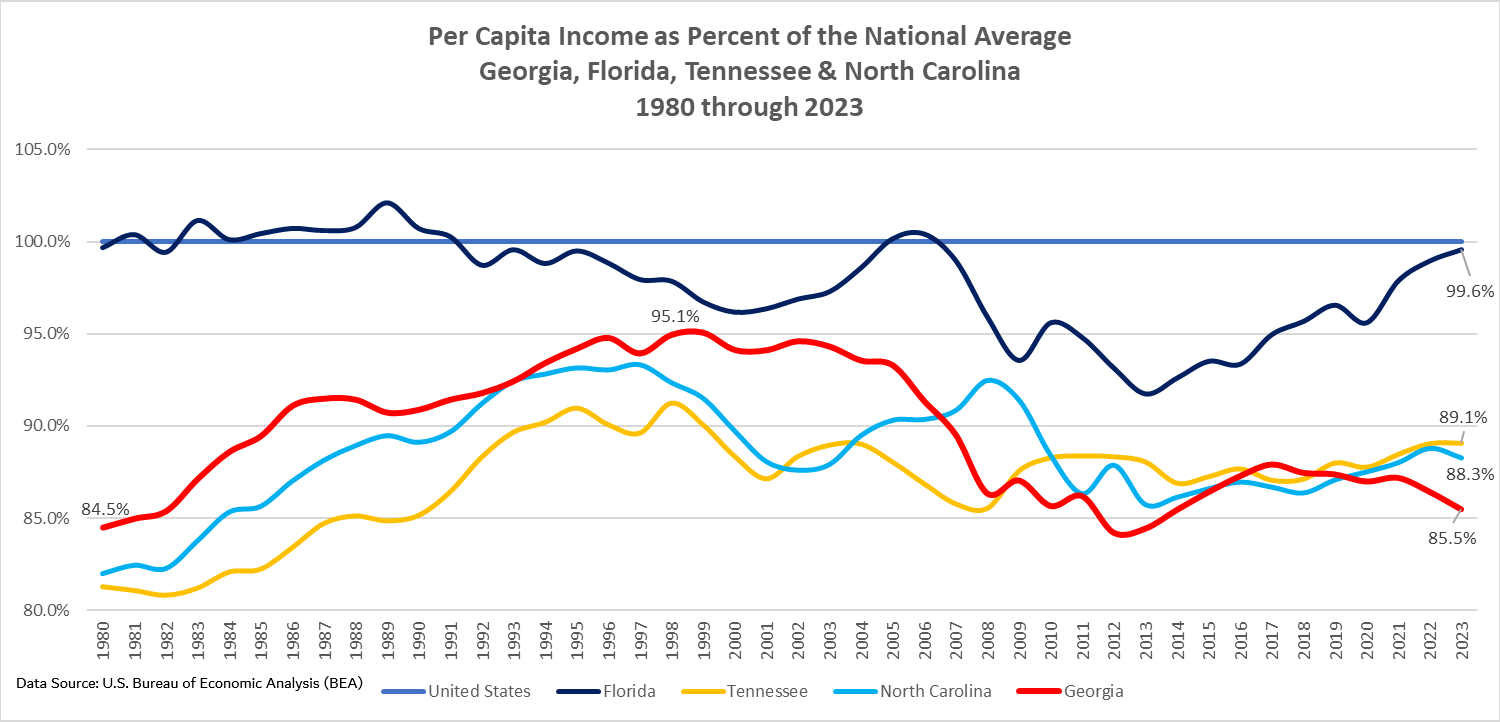

For more than a year, TIGC has been focused in no small part on the inexplicable collapse of Georgia’s per capita income (PCI) performance. We’ve documented that disproportionate shares of our population and huge swaths of our geography have fallen into the bottom national ranks for various important economic metrics, including — in addition to PCI — median household income, poverty and gross domestic product (GDP) per capita. We’ve come to regard this as a major part of the TIGC story and plan to maintain a sharp focus on it.

Politics

Articles from other media about important rural issues

Golden Oldies

A collection of vintage TIGC stories that still attract reader interest

Politics

-

Elections really do have consequences

Pregnant women in Franklin County and neighboring areas of northeast Georgia can no longer deliver babies at St. Mary’s Sacred Heart Hospital just outside Lavonia. But Georgians and, indeed, all Americans now have the privilege of being able to buy gun silencers without having to pony up a $200 tax. How, you might wonder, are…

-

Carter’s funeral and Trump’s inaugural: Bookends to a troubled half-century

After nearly two years in hospice care at his home in Plains, Ga., Jimmy Carter passed away Sunday afternoon at the age of 100. His family had said a few months ago that the nation’s 39th president was set on hanging on until he could cast his vote for Kamala Harris over Donald Trump. He…

-

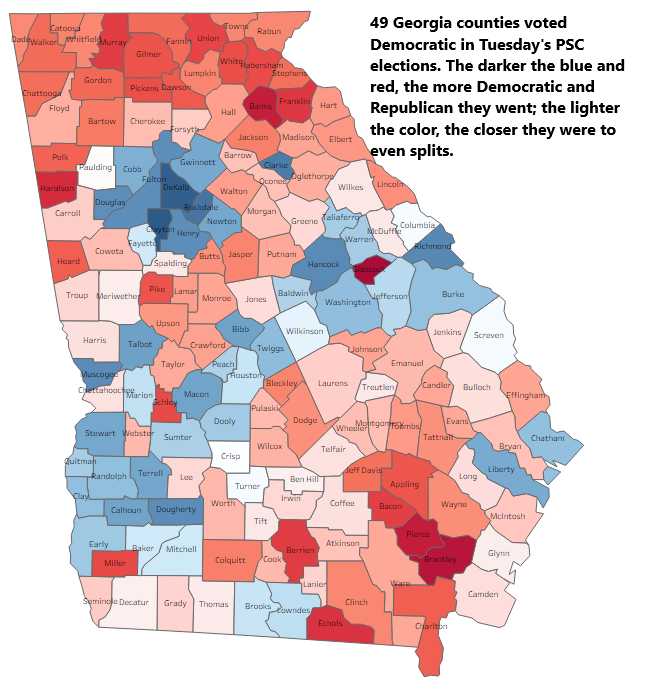

Early TIGC notes on the 2020 election and the two political Georgias

Trouble in God’s Country’s preliminary take on Tuesday’s still-being-counted presidential election results: First, Georgia’s overall political map won’t change much if at all. President Trump, the Republican incumbent, and Democratic nominee Joe Biden are carrying the same counties their parties have carried in the past few election cycles, as this map illustrates. Trump will carry…